PPF is one of the most popular long term investment schemes in India. PPF stands for Public Provident Fund and all Indian citizens are eligible to open a PPF account, regardless of work type, pay, and tax slab. It is essentially a long term saving and also a tax saving instrument introduced by the National Savings Institute of the Ministry of Finance in 1968. This works slightly differently from PF or Provident Fund. While the employer opens your PF account and adds money to your PF account with your monthly salary, a PPF account is a personal account that you can manage.

Once you open a PPF account, you will have full control over it and you can add money to the account whenever you want. One of the main objectives of the PPF account is to encourage savings for the long term, get a reasonable income and also get income tax benefits. You can open a PPF account even if you have a PF account and get tax benefits. Ways to open a PPF account include using internet banking, the mobile app and even offline. In this guide, we will cover a basic explanation of what a PPF account is, its benefits and how you can open a PPF account.

Also Read: PF Balance Enquiry: How to Check Your EPF Balance via Website, App, Missed Call Service, and More

What is a PPF Account?

As said earlier, PPF stands for Public Provident Fund. It is one of the most popular long term investment options available for Indian citizens. It is a tax-saving investment introduced by the National Savings Institute of the Ministry of Finance. Since it is a long-term investment, the return rate is better than what you’d get with other deposit options like fixed deposit and recurring deposit.

The PPF account’s minimum yearly deposit is Rs 500 and you can deposit a maximum of Rs 1.5 lakh into a PPF account in a financial year. While you can add more than 1.5 lakh in a year, anything above Rs 1.5 lakh will not earn interest. You can add money to the PPF account in multiple installments, either spread out over a year or as a lump sum. The Government of India announces the rate of interest for the PPF account every quarter and interest is compounded annually and paid in March every year. As of April 21 – March 22, the rate of interest is 7.1%.

Lastly, the duration of a PPF account is 15 years and you can either close and draw the full amount or you can expend it for multiples of 5 years like 5, 10, 15 years with or without making any further contribution.

PPF Withdrawal Rules

You can also partially withdraw the funds in your PPF account before completing 15 years. You can withdraw up to 50% of the amount in the account at the end of the 5th year However, only one withdrawal can be made in a financial year.

How to Open PPF Account Online

You can open a PPF account with any nationalized bank, post office, and also with some authorized private banks in India. The account can be opened by any Indian citizen under their name and even minors can open the account with the help of a guardian. Parents can act as a guardian for such accounts.

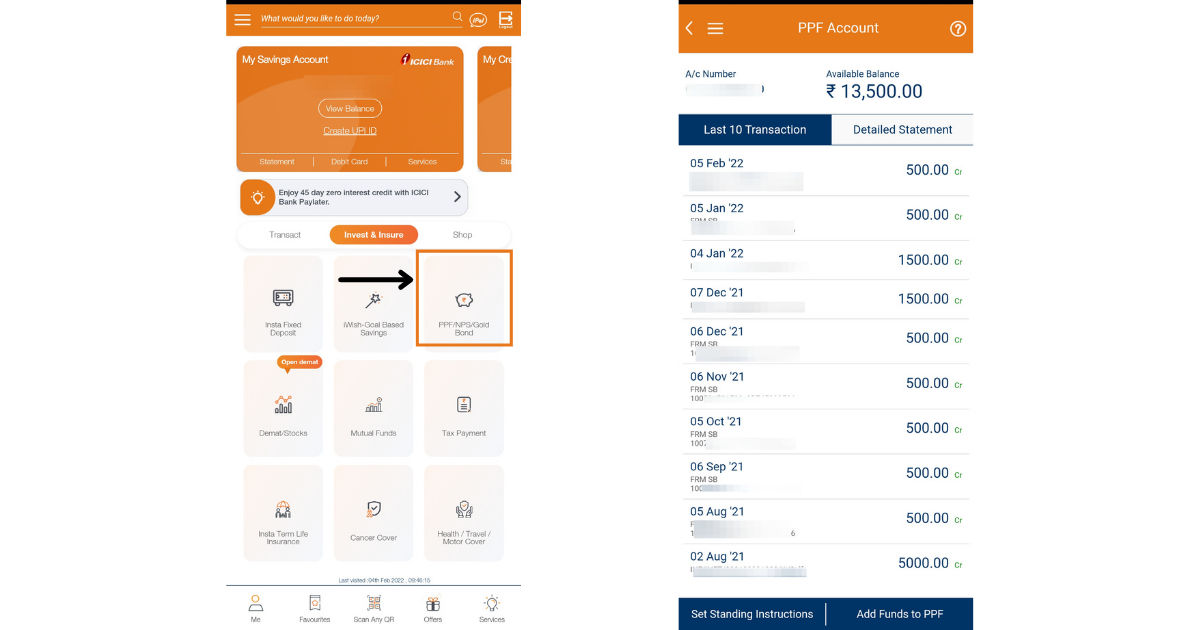

Opening a PPF account online is a simple process if you have already activated internet banking or have a mobile banking (app) facility enabled by your bank. All you need to do is go to Accounts > “PPF account” tab on the website and verify your name, address, documents, and add nominee. Once this is done, you will be asked to make an initial deposit which can be as low as Rs 100.

You can either set up standing instructions, which will automatically deduct money from your savings bank account and add it to your PPF account every month/ quarter/ year or you add money manually whenever you want.

| Bank Name | Links |

| Axis Bank | PPF Account Link |

| Bank of Baroda | PPF Account Link |

| Bank of India | PPF Account Link |

| Bank of Maharashtra | PPF Account Link |

| Canara Bank | PPF Account Link |

| Central Bank of India | PPF Account Link |

| HDFC Bank | PPF Account Link |

| ICICI Bank | PPF Account Link |

| IDBI Bank | PPF Account Link |

| India Post | PPF Account Link |

| Indian Bank | PPF Account Link |

| Punjab and Sind Bank | PPF Account Link |

| SBI Bank | PPF Account Link |

| UCO Bank | PPF Account Link |

| Union Bank of India | PPF Account Link |

Alternatively, you can open a PPF on your bank’s mobile app too, which also includes the same steps.

How to Open PPF Account Offline

In case you find opening a PPF account hard on the mobile app or internet banking, the next best option is to visit the branch by yourself and get it done. Here is how you can open a PPF account offline:

- Visit the nearest bank where you already have an account

- Talk to the Bank representative and get PPF form

- Fill out the form and provide the necessary documents required

- Submit the form and the amount to make your first deposit

- Once the bank verifies your details, your PPF account will be activated

Documents Required to Open PPF Account

Here are the documents you need to keep handy while opening a PPF account.

- Identity proof: Aadhaar card/ PAN card/ voter ID card/ passport/ driving license

- Address proof: Aadhaar card/ Ration card/ telephone bill/ electricity bill

- Age proof (if minor): Aadhaar card/ birth certificate

- Document of parent/guardian in case of minor account

- Pay-in slip (offline only to make an initial deposit)

- Passport size photo (offline only)

- Nomination form (offline only)

Eligibility for Opening PPF Account

All Indian residents are eligible to open a Public Provident Fund account, including minors. NRIs (Non-resident Indians) are not eligible to open a new account, but they are allowed to continue their existing PPF accounts up to the 15 year maturity period.

FAQs

What are the minimum and maximum limits in a PPF account?

A yearly deposit of Rs 500 is the minimum amount to maintain a PPF account. A maximum of Rs 1.5 lakh can be deposited to your PPF account in a financial year. However, anything above Rs 1.5 Lakh will not earn any interest.

Can a PPF account be used for tax savings?

Absolutely, in fact, most PPF account holders use and maintain the PPF account to save on tax and get more benefits. All the contributions made in a financial year qualify for tax deduction under Section 80C of the income tax act as per the old Tax regime. The tax benefit is capped at Rs 1.5 lakh in a financial year.

Can you avail loan from a PPF account?

You can avail loan based on your PPF account from the third financial year to the fifth financial year. You will be charged interest against the loan taken. The rate of interest charged on a loan taken by the subscriber of a PPF account on or after December 12th 2019 shall be 1% more than the prevailing interest on PPF. Up to a maximum of 25% of the balance at the end of the 2nd immediately preceding year would be allowed as a loan. Such withdrawals should be repaid within 36 months.

You can also get a second loan as long as you are within the third and before the sixth year, and only if the first one is fully repaid. Once you are eligible for withdrawals, you won’t be eligible to take loans. Only active PPF account holders are eligible for loans.

The post PPF Account Online: How to Open a PPF Account, Document Required, Eligibility, Withdrawals, and More appeared first on MySmartPrice.

from MySmartPrice https://ift.tt/ndRx3Xy

No comments:

Post a Comment