The Indian smartphone market is on a path to recovery amidst the COVID-19 pandemic as it has registered the highest shipments in Q3 2020. This is as per the latest report from Counterpoint which suggests that the Coronavirus induced slump in the smartphone market of India is now fast on its way to recovering to pre-COVID levels and then some.

The research and analysis company has found out through its Market Monitor service that the Indian smartphone market saw as many as 53 million smartphone shipments in the third quarter with a 9% year-on-year (YoY) growth. Counterpoint’s report is in line with the Canalys report released last week that revealed that smartphone shipments in India hit 50 million units in Q3 2020 registering an 8% YoY growth.

“Due to the pandemic, Indian consumers have ended up saving on leisure activities. These savings are now being funnelled into smartphone purchases. Additionally, smartphones have become an integral part of consumers’ lifestyle in this changing environment,” said Prachir Singh, Senior Research Analyst at Counterpoint.

Insights from Counterpoint’s Q3 2020 report

According to the estimates by Counterpoint’s Market Monitor service, the third quarter witnessed a strong comeback for most smartphone brands due to the increased demands and supply-chain getting back on track after the lockdown. The demand is also in-part primarily due to the online sales and shopping events such as Prime Day 2020 that was hosted by Amazon in August.

Furthermore, these sale events by e-tailers have only become more frequent in the heads up to the festival season in the country with smartphone brands announcing lucrative offers to attract more buyers. Due to the lockdown in the second quarter, more people have started working from home and students have been taking classes from the safe confines of their homes as well. As such, smartphones have become a necessity now more than ever for people to stay in touch while also fulfilling their entertainment needs.

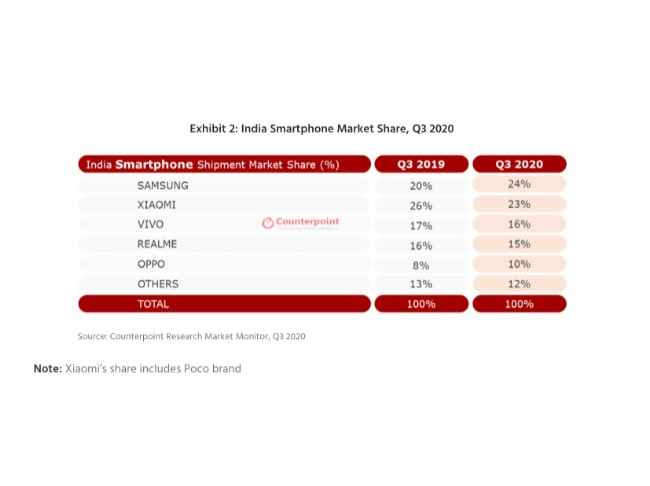

With this, the mid-range smartphone segment between Rs 10,000 to Rs 20,000 saw the highest growth in the third quarter. Samsung led the Indian smartphone market in Q3 2020 after nearly two years with a 24% share followed by Xiaomi with 23% share.

While the Canalys report suggests that Xiaomi is still the numero uno player in the Indian smartphone market with around 26% share, the Counterpoint report indicates Xiaomi has slipped to the second position after two years. In comparison to Q3 2019, Xiaomi commanded 26% market share followed by Samsung with 20% share.

Vivo retained its third position with 16% share followed by Realme with 15% share and Oppo with 10% market share. Realme and Oppo both witnessed growth in the third quarter, especially in the budget segment.

In the affordable premium segment and upper mid-range segment, OnePlus Nord and OnePlus 8 drove the sales for the company to remain a top brand. The Nord is a best-seller in the sub-Rs 30,000 segments and coupled with the recent sale events it's expected to grow further in the fourth quarter.

Apple is leading the premium smartphone segment of the Indian market before the iPhone 12 series hits the shelves due to the strong demand for the mid-range iPhone SE 2020 and last year’s iPhone 11 that has now received a price cut.

It will be interesting to see how the last quarter of the year goes especially with smartphone launches in October and the slated comeback of Indian smartphone brands like Micromax and Lava Mobiles. Moreover, the report hints at the 10% customs duty levied on displays and touchscreens from Q4 2020 which is expected to increase production costs of phones that use imported displays but is expected to boost domestic production.

from Latest Technology News https://ift.tt/2Gc7TBG

No comments:

Post a Comment